Oradian offers financial providers the tech they need to grow

With their customisable core banking platform, Oradian gives financial institutions the ability to quickly scale and launch new products in emerging markets. Working with 50+ organisations in sub-Saharan Africa, Europe and Southeast Asia, they are bringing new financial possibilities to over a million end-users.

Financial services

Impact Indicators

55

Organisations served

1,370,000

Users reached

63

Full-time employees

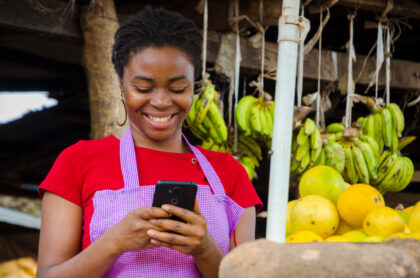

Digitising financial services for more inclusive economies

Costly IT and related expertise often prevent local financial institutions from expanding and reaching new customers. Oradian’s technology empowers microfinance institutions, cooperatives, and rural banks to digitise core operations, manage loans more efficiently, and offer better customer experiences. Serving customers from their offices in Nigeria, Croatia, and the Philippines, Oradian’s adaptable SaaS platform is particularly valuable in rural and underserved areas where financial access remains limited and operational inefficiencies hinder scale.

Why Goodwell invested

Access to basic financial services like loans, payments, and savings is essential for increasing financial inclusion and economic participation. Oradian takes a technology-led approach to making financial services more affordable and accessible, providing an efficient, cost-effective way for financial institutions to serve lower-income populations at scale.

Recent achievements and future ambitions

Oradian’s digital banking technology is directly contributing to the affordability of financial services for a rapidly growing user base, which totaled 1.37 million end users by the end of 2024. The company has also continuously improved its platform’s scalability and efficiency, enabling financial institutions to lower their operational expenses. Finally, Oradian is working to expand their geographical footprint, and started offering their services in Indonesia in 2025.