Making a lasting impact can take time and patience – two resources in short supply in today’s world. But patience isn’t just a virtue: it can be a valuable strategy for investors with the right mindset.

What is patient capital?

Based on a long-term investment outlook, patient capital is an approach that allows money to work for longer. It extends funding to promising, early-growth stage businesses, prioritising the potential for long-term results over quick profits. The current venture capital market, however, prefers liquidity and speedy returns, putting the concept of patient capital under increasing pressure. But for Goodwell (and impact investing in general) patient capital is at the core of our work – especially in emerging African markets, where resilience and system-level change won’t be built overnight.

A vital tool for lasting impact

We firmly believe that impact investing is still investing; our aim is to make good financial returns, but not at the expense of people or our planet. Balancing profit and progress can take time. Just like natural ecosystems, business ecosystems take time to evolve and adapt before they can deliver results. Goodwell works to build thriving, resilient, impact-focused businesses. Our differentiator isn’t how fast we exit; it’s about the quality of the company we help build through years of hands-on involvement, working alongside founders to develop long-term strategies, strong teams, and scalable solutions. We’re aiming for long-term success, not just a quick win, leaving portfolio companies positioned to succeed when – and long after – Goodwell departs. Patient capital is an essential tool for our goal of creating lasting, systemic change.

Why does Africa need patient capital?

It’s no secret that investing in Africa comes with its own set of risks and rewards. Rather than shying away, Goodwell embraces the continent’s challenges, knowing that local expertise, resilience, and patience can yield vast opportunity. What makes patient capital such a crucial component of our approach?

Building trust takes time

We work in a people-first, high-touch way, believing that trust is earned over time and is the foundation of good working relationships. Patient capital allows the time and space for such collaboration.

Emerging markets need longer runways

Africa’s infrastructure can be a challenge, regulations may be evolving, and access to capital is often limited. These aren’t insurmountable problems, but they take time to solve. Patient capital allows businesses the space needed to work around such obstacles for sustainable scaling.

Goodwell’s focus sectors scale gradually

We invest in companies that provide essential goods and services to underserved communities, like agriculture, financial inclusion, and mobility. By their very nature, these industries scale over years, not quarters, but consistently deliver beneficial impacts to local people and communities.

Patient capital fills a crucial funding gap

While early-stage start-ups remain attractive to investors, there is a global shortfall of funding for businesses in the scale-up phase. This is especially true in Africa and emerging markets. Deployment of patient capital bridges that gap and affords companies vital growing room

We invest for resilience, not just returns

Our goal is to set companies up for success in the long term. Patient capital refutes the traditional venture capital “in, out, quick cash” pattern. We want to support a business through responsible, sustainable growth, rather than storming the exit doors.

Goodwell prioritises responsible exits

Goodwell will always take the time to find the right purchasing partners in the case of an exit – and, because we often invest in innovative solutions, we need to afford room for the wider ecosystem to be ready for a company’s next move.

What effects does patient capital have?

Patient capital = more time. And with more time, we can go further and do more. Goodwell has seen firsthand what it enables: by giving businesses more time to grow sustainably within their sector and context, we’ve built a stronger, more resilient portfolio, which allows for deeper impact in our markets. Patient capital also allows us to wait for the right exit partner, aligned with the company’s mission and vision, ensuring ongoing impact into the future.

This approach also offers a host of wider-reaching impacts; patient capital can catalyse economic development by contributing to a region’s economic stability. It unlocks further investment by giving companies the time to mature and prove their business models, making them more appealing to risk-adverse investors. Patient capital helps to drive inclusive growth, spurring on important sectors like clean energy and education, and contributing to the aims of the UN Sustainable Development Goals.

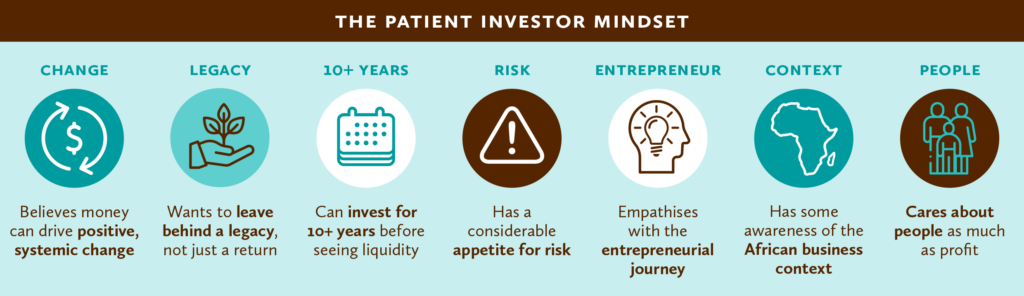

Who are patient capital investors?

The arguments in favour of patient capital are good ones – but it’s not for everyone. Patient capital investors need a certain mindset, focused on the long term and driven by values. But for those willing to make the shift, the payoff – both impact and monetary – can be profound.

“At Goodwell, patience isn’t a compromise; it’s an advantage,” shares Nico Blaauw, Partner at Goodwell. “Our investors are in tune with global events, humanitarian concerns, and sustainable development. Whether they come to us through a family office, DFI, finance institution or as individuals, they all invest their money to build impact as effectively as possible. And they do realise that building resilient inclusive business takes time. Contrary many passive investors in mainstream early growth capital funds, most of Goodwell’s investors are highly engaging, with in-depth screenings, by asking all the tough questions, and challenging our growth assessments and investment evaluations. And that’s how we have like it because ever since we started our investors have strong emotional and financial interests in our work. They understand that an inclusive future will be built by empowered entrepreneurs, resilient companies, and systemic change – work that simply can’t be rushed even more so in the markets in which we invest.”