Investment spotlight: Good Nature Agro

The company that’s future-proofing agriculture in sub-Saharan Africa

Agriculture is an incredibly important economic and social contributor in Africa.

You might be surprised to learn that a staggering 70% of the population in this region—home to 1 billion people—consists of smallholder farmers. In fact, most of the land here is held by farmers who own less than 5 hectares (ha). Collectively, they produce 80% of the food supply and contribute an estimated 23% to Gross Domestic Product (GDP).

The region has the capacity to double or even triple the amount of cereals and grains it currently produces, which means that it could feed both itself and the world. If smallholder farmers across sub-Saharan Africa could boost productivity, then the region’s food security and economic conditions would improve significantly.

Zambia is perfectly positioned to take advantage of the opportunity. It has an abundance of fertile land, a favourable climate, and good water resources. Of the 75 million hectares of total land area, an estimated 42 million hectares (56%) is suitable for agriculture, and despite the low levels of irrigation, the country has sufficient water resources (ground, rain and surface) available to support rain-fed agriculture.

The country is landlocked, bordered by eight countries in Central and Southern Africa. This strategic location in the Common Market for Eastern and Southern Africa (COMESA) and Southern Africa Development Community (SADC) gives preferential access to regional markets.

Unfortunately, despite the opportunity, smallholder farmers in Southern and Eastern Africa currently have the lowest yield per hectare compared to other developing regions throughout the world.

Why? Well, there are three problems that need to be overcome:

The first, is that the sector requires significant investment in improved seed and other factors such as affordable fertiliser, storage facilities and irrigation.1 Only a seed company can drive product substitution and open new markets for crops.2 High-quality seed is also key to increasing agricultural production and providing food security for the rising population in both the region and the world. Producing high-yielding, climate-smart seed that is adapted to the area of production and is disease resistant are basic factors for good crop performance and yield.

The second challenge is that the seed needs to be made available to the smallholder farmers. These farmers need to be engaged and given access to high-quality seed, finance, inputs and technical assistance to improve their yields.

The third challenge involves improving market information to bridge the supply gap. Smallholder farmers have poor market linkages to off-takers of their produce. As a result, they do not have direct access to mass markets to negotiate competitive prices and solve market supply challenges.

Good Nature Agro: the seed-to-sale company that’s changing the fortunes of smallholder farmers in the region

Good Nature Agro was founded in 2014 by Carl Jensen, Sunday Silungwe and Kellan Hays to address the challenges outlined above.

The company’s product focus is on legumes (soya beans, groundnuts, mixed beans and cowpeas), which have niche markets and deliver high commercial value. They are also climate smart because they are more drought resistant than other cash crops, are nitrogen fixing, and are cheaper to grow.

Since its inception, Good Nature Agro has doubled farmer yields, tripled farmer income, and grown its markets to include Malawi and Zimbabwe, and has demonstrated consistently strong revenue growth.

Testament to our ecosystem approach to investing, we were introduced to Good Nature Agro in 2019 by three different parties in short succession.

First, we were introduced by the founder of Bongo Hive, Zambia’s first innovation and technology incubator. Soon after this, Wim van der Beek, our Founder and Managing Partner, received an email from a close associate who knew the company well. Not long after this, our East Africa team met the founders of Good Nature Agro at an event in Kenya. This team contacted our Southern Africa investment team and recommended that they set up a meeting with the company.

The timing was perfect. We were actively looking to diversify our uMunthu fund by investing in tech-enabled innovative agribusiness models in the region.

Investing was a no-brainer

When it comes to investing in agriculture in Africa, we look for companies that focus on optimising existing realities. We appreciate the fact that Good Nature Agro is not trying to turn smallholders into large commercial farmers. Instead, the team is working to strengthen their position in the value chain by providing access to inputs, finance, training and new farming techniques and market linkages.

Legumes are a good investment. Rising global consumer awareness concerning the health benefits of legumes is contributing to increasing demand from industries including canning, edible oils, food processors, and animal feed – all of which are forecast to grow well. There is already a large shortfall in sub-Saharan Africa, with countries like South Africa importing processed legumes from South America and China.

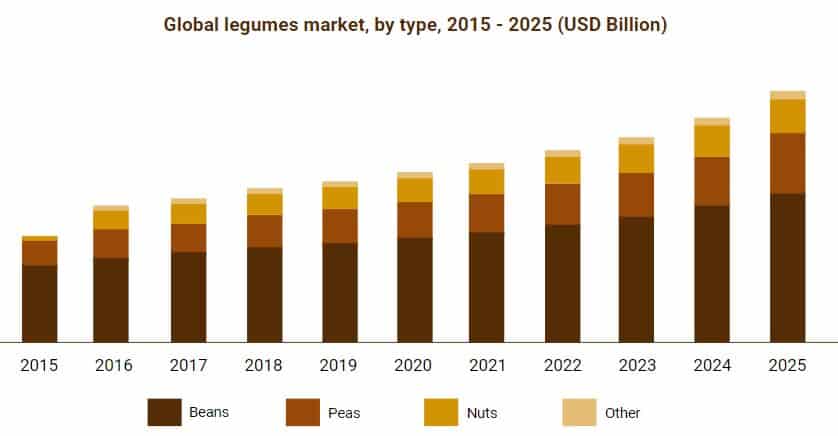

In 2017, the global legumes market was valued at USD 44.9 billion and, by 2025, it’s expected to reach USD 75.8 billion at a CAGR of 6.77%.

Figure: The global legume market is expected to reach USD 75.8 billion by 2025. Source: Hexaresearch

Growing and processing legumes in sub-Saharan Africa makes excellent commercial sense, and will help the region become increasingly self-sufficient.

We also like the fact that Good Nature Agro adds value across the entire supply chain (from seed to sale), and we appreciate the fact that they offer a path to financial inclusion for smallholder farmers. Mercy Zulu-Hume, who led the deal from our Southern African Investment team, is Zambian and comes from a family with a strong agricultural background so she understands the value of the work that the company is doing with the farmers. As she says, “The only way to unlock the opportunity in the region is to bring the smallholder farmers along on the journey.”

Figure: Most land in sub-Saharan Africa is held by smallholder farmers who collectively produce 80% of the food supply.

Transforming the supply chain from seed to sale

Good Nature Agro has two divisions, Good Nature Seed and Good Nature Source.

Good Nature Seed is the part of the business that works out which seed varieties are in demand and produces seed for those select varieties with a network of smallholder farmers . It gathers input from regional and international agribusinesses to define desired crop characteristics, communicates with private and public stakeholders, and conducts R&D on its Foundation farm. The Foundation farm is where the company multiplies the seed before passing it into the Good Nature Seed network of out-growers.

Selected legume varieties are brought into Good Nature Agro’s growing network of 4,600 smallholder seed producers—35% of which are women. These farmers are producing an integral input that other farmers throughout the region will plant in the subsequent season. Each of these growers receives access to the full bundle of Good Nature services including access to inputs, full input financing, personalized training and business planning, and the guaranteed market of selling their seed to Good Nature. Thereafter, the company sells the seed that it sources to various clients. The seed produced by Good Nature’s smallholder seed grower network during the 2020-21 season is currently being planted by an estimated 150,000 farmers as the genesis of their 2021-22 season.

Good Nature Source is the part of the business that works to guarantee buyers for smallholder farmers’ commodities. It’s an innovative sales and production model whereby the company first establishes agreements with food processing companies and large-scale agribusinesses that require specialty legume crop, and then contracts customers of Good Nature Seeds to grow these legumes using the seeds it has developed.

This linked contracting approach enables Good Nature Agro to introduce larger groups of smallholder farmers to formal seed varieties which deliver better yields, more desirable characteristics, and higher prices. Currently the Good Nature Source model is engaging over 21,000 farmers in Zambia and Malawi.

A smart investment with the power to transform lives and economies

Good Nature Agro is an incredibly exciting investment for Goodwell Investments, and a perfect fit for our uMunthu fund.

This is our fourth investment in the agricultural sector, and like the others, it aligns with our core investment philosophy of financial inclusion (in this case by offering farmers credit and additional financial services). It’s at this convergence of sectors that we see the biggest impact.

This investment is strong in all three sustainability pillars:

- Financial sustainability: The company has a strong business model that is sustainable, operating in an industry with large commercial opportunities.

- Social sustainability: The company works with smallholder farmers, and follows ethical and responsible business practices. Growing and improving the agriculture industry in Zambia helps keep wealth within the continent (as opposed to exporting raw materials and then importing processed goods at a higher price).

- Environmental sustainability: Good Nature Agro is conscious of the environment and has chosen to work with a crop that is climate wise, nitrogen fixing, good for soils, and a supplier of higher quality nutrition.

Agriculture has the power to transform lives, and when the vast majority of people in a country work in the industry, improving it has the potential to transform the economy and positively impact the lives of millions of people.

The natural environment is a precious resource and following sustainable agricultural practices is one of the best ways to care for it. The more the world can do to transform and future-proof agriculture, the better for us all.

Learn more

If you are an investor and would like to learn more about our agricultural investments and track record, schedule a call with us.

If you are an agribusiness in Africa and are looking for funding to scale, please apply here.