Investing in inclusive agriculture to drive systemic impact

Feeding the world’s growing population can feel like an insurmountable task, but there are also reasons to be hopeful. Find out how our investments in African agricultural innovators improve local processing, build more efficient value chains, and reduce post-harvest losses to make high-quality food more accessible and affordable.

Growing, preparing, and enjoying good food is one of humanity’s most basic instincts, and a universally uniting pleasure. But in 2023, between 713 and 757 million people – one out of every eleven people on earth, and one out of every five in Africa – experienced hunger, while billions experienced food insecurity. At the same time, the UNEP warns that food waste and loss is a chronic, global issue, accounting for a loss of one billion meals per day, 8-10% of global greenhouse gas emissions, and wasting the equivalent of 30% of the world’s agricultural land. The world’s population is expected to grow to 9.1 billion by 2050, with half of that growth happening within Africa. The agricultural sector urgently needs to address waste and increase production by 70% to feed humanity’s future.

Current challenges in Africa’s agricultural sector

With this inevitability looming over future crops, current agricultural challenges are even more pressing: Africa’s farmers are on the front lines of climate change, with many enduring chaotic weather, natural disasters like droughts, and pest and disease outbreaks. Unsustainable land management across the continent is further encroaching on vital natural ecosystems while degrading soil and water quality.

Smallholder farmers, who produce the majority of Africa’s food, often have limited access to high-quality inputs and training, negatively impacting their production capabilities. They tend to face challenges in accessing financing too: a flow of money is a necessity for farmers to cover essential supplies, innovate and/or expand their operations, but such progress is constantly hampered for African smallholders by a lack of basic banking services, credit history, and/or collateral for loans. And all the while, insufficient market access, political instability, gender inequality, and massive post-harvest losses aggravate the situation.

A clear opportunity for system-wide impact

What needs to happen next? Well, we need to feed more people (access). We need to reduce consumer prices (affordability). We need to cut emissions (sustainability), and we need to create high-quality jobs (livelihoods). All simple answers but requiring complex, system-wide efforts to enact.

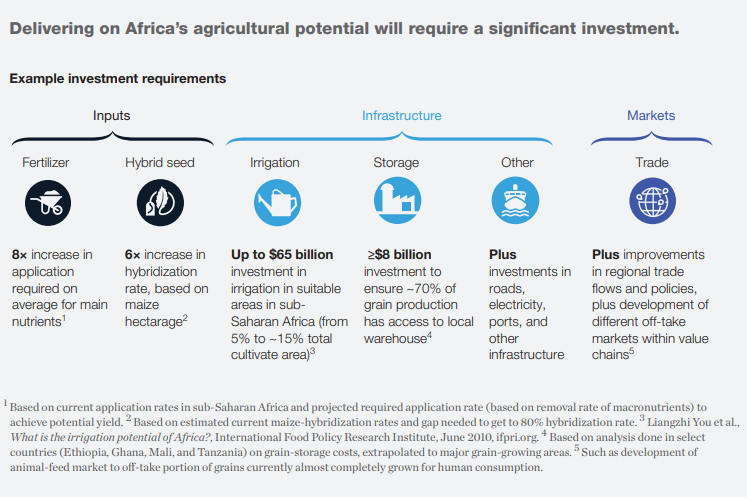

The investment community has a massive role to play building a more inclusive agricultural sector that can feed a growing population. The Food and Agricultural Organization (FAO) estimates that to properly address the “food gap”, developing countries need an average annual net investment of around USD 83 billion – an increase of about 50% on current investments. Africa’s agricultural potential can only be met by improving agricultural inputs, infrastructure, and markets. This will need a major reallocation of national budgets, supportive policies, an increase in donor programmes – and for private investors to step up. It’s why Goodwell has been steadily increasing our portfolio in African agriculture, and why we have dedicated over 35% of our uMunthu II Fund exclusively to investment in the sector. There is ample opportunity for engagement – according to a 2020 McKinsey report, investment opportunities could total over USD 400b in the following sectors combined:

Image source: McKinsey Report, “Winning in Africa’s agricultural market”

A holistic, systems-change approach

Goodwell supports the innovation and implementation of pragmatic, scalable solutions based around the central “pillars” of access, affordability, sustainability, and livelihoods. We focus on strategic impact and systemic change: our efforts emphasise local processing, more efficient value chains, and reduced post-harvest losses.

In other words, we don’t just look at how to produce more food – we consider the underlying challenges and opportunities of the entire agricultural ecosystem to maximise the quality, availability and affordability of food at every step of the production process. We also recognise that better food and agricultural outcomes are contingent on many other economic and societal factors – from local infrastructure to smallholders’ access to financing.

We catalyse progress in these areas of the food and agriculture sector by investing in asset-light, service-oriented or processing business models that also have the potential to deliver solid market returns. And we look for companies who are “ecosystem players”, working actively with industry partners in multiple layers of the supply chain. This provides us with ample opportunity to maximise the long-term impact potential of our portfolio companies.

Creating impact that builds resilience

Each company in Goodwell’s food and agriculture portfolio contributes to access, affordability, sustainability, and quality livelihoods by addressing a systemic shortcoming through scalable solutions. While they each take a holistic approach to their specific section of the sector, Goodwell’s overarching view builds synergies across the entire sector, and within our own funds. When looking for potential investees, we focus on building local capacity, supply chain improvement, reducing consumer costs, and less resource-intensive production with limited crop risk. These hallmarks guide us towards maximum impact with fair returns, while addressing Goodwell’s specific, strategic agriculture goals:

Local processing

Processing food where it’s grown avoids unnecessary transport emissions, creates jobs, and increases affordability. For example, Chicoa is a locally focused, tilapia-farming aquaculture company, increasing access to a lower-carbon protein in Mozambique, while also improving food security and supporting gender inclusion. In a similar vein, Tomato Jos is meeting the rising demand for food by producing locally grown tomato paste for Nigerian consumers. The company is enhancing the livelihoods and gender inclusion of Nigerian smallholder farmers by building their resilience and sustainability with training and high-quality inputs. Partner farms have seen average crop yields increase from 2.5MT to 8-10MT per hectare.

More efficient value chains

More efficient agricultural value chains increase quality and profits, while lowering emissions, optimising resource use, combating waste, reducing costs for both producers and consumers, and building resilience. In our portfolio, Good Nature Agro’s (GNA) work begins at the very base of the agricultural supply chain, starting with their own drought-resistant seeds. They improve smallholder farmers’ livelihoods while growing nutritious, climate-resilient crops. Goodwell supports their transformative approach of improving inputs, increasing technical trainings, and providing access to high-value markets for rural Zambian legume farmers. Zambia recently faced a hundred-year drought, proving the resilience of GNA’s seeds and crisis approach: GNA’s farmers suffered 40% less yields, compared to the national average of 60-100% crop losses.

Another of our portfolio companies, Complete Farmer, is scaling up climate-smart agriculture by optimising supply chains. Their end-to-end digital marketplace is preparing the sector for the future, attracting new investment and connecting West African farmers with global markets. Souk Farms’ cold chain logistics minimise food waste, and the company also tackles agricultural inefficiencies in Rwanda by combining in-house farming operations with a wide network of out-growers. The company applies sustainable practices across its entire farming network. Their approach enhances market access for smallholder farmers by connecting them to high-value international markets.

Reduced post-harvest losses

With as much as 37% of Africa’s crops wasted post-harvest, reducing that loss is one of the surest methods for getting high-quality products to eager consumers. East Africa Foods is working to eliminate Tanzania’s post-harvest losses by improving distribution infrastructure, aggregating smallholder produce, and delivering it directly to urban retailers. Origen Fresh in Kenya turns post-harvest losses into a valuable business opportunity, producing vegetable and essential oils (particularly avocado), and emphasising resilience, food security, and rural economic development in Kenya. They pay a fair price to farmers for avocados (and other crops) unsuitable for export and turn this “waste” into a valuable product. Origen integrates climate-smart approaches into its business model and have broadened access to agricultural markets for 300,000 small-scale farmers – 147,000 of whom are women.

Direct benefits and immediate impact

As you can see, Goodwell goes beyond “merely” feeding hungry mouths: our approach entails caring for the earth, restoring and preserving soil and water quality, encouraging biodiversity and sustainability, preventing post-harvest losses, and fostering decent, inclusive livelihoods. From improving agrisystems to building up market access, this holistic strategy is making significant impact.

Our investments in systemic solutions are already directly benefitting 350,467 smallholder farmers and 2,159 employees, producing and transporting thousands of tonnes of high-quality, affordable produce, supporting thousands of women within the sector, and reaching 39+ million households. Not only that, but we’re delivering market-rate returns to our investors.

Agriculture is a major driver of growth in Africa, accounting for almost a quarter of national GDPs and employing over half the population. The sector’s evolution is crucial for the continent’s future, and it has serious potential – it just needs the right support.