For over two decades, Goodwell Investments has been at the forefront of impact investing, advocating for inclusive workplaces and championing female entrepreneurs. Despite significant progress towards gender equality, the journey is far from over. Recent findings underscore the persistent challenges women face in leadership and access to funding — highlighting the crucial role of impact investors in driving meaningful change.

The gender gap: diversity dividend report

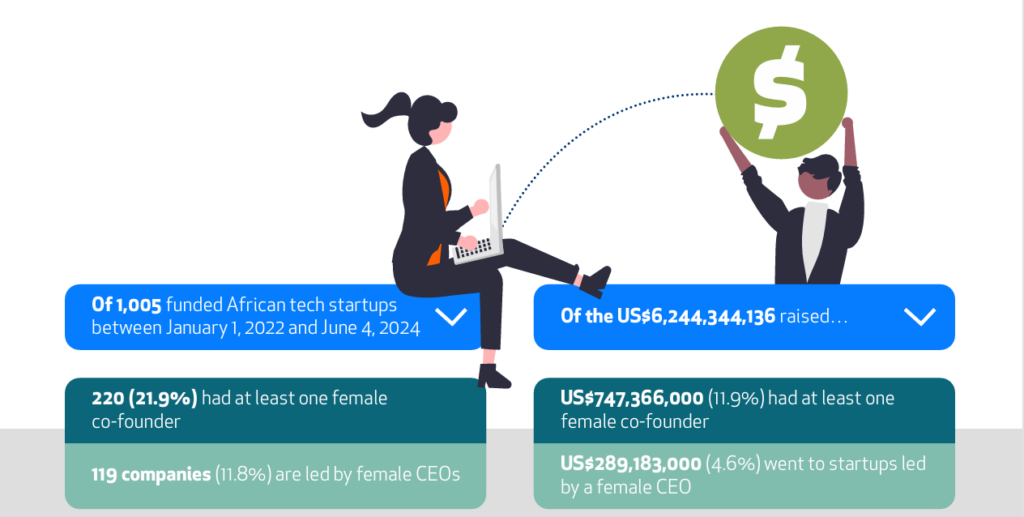

To learn more about the state of female leadership and access to finance, we partnered with Disrupt Africa on their 2024 Diversity Dividend report. Although the findings show that the situation is improving, it is still nowhere near where it needs to be. Women remain significantly underrepresented in leadership roles across sectors, with only 17.3%of African tech startups having at least one female co-founder in 2024. Women also struggle to access funding at the same level as their male peers; the report found that only 11.9% of total funding raised by African tech startups went to ventures with at least one female co-founder, and a mere 4.6% went to female-led startups.

There are many underlying structural and societal issues contributing to the gender disparity in funding. Impact investors can do their part to close this gap by using a gender lens investment approach. We asked Els Boerhof, managing partner at Goodwell, what gender lens investing means: ‘The concept is not only about supporting female entrepreneurs. Gender lens investing is all about focusing on inclusive impact, and particularly targeting women who are often marginalised and underrepresented in society.’

Goodwell’s evolving approach to gender lens investing

The needs of women have always been part of Goodwell’s investment process as we investing in locally lead companies that provide basic goods and services to underserved communities. With our roots in microfinancing, first in India and later in Africa, many of our portfolio companies naturally serve women.

Our focus on female stakeholders only increased as we expanded our investment mandate beyond financial inclusion to mobility and logistics, and agriculture – a sector that is largely dominated by women throughout Africa. Over time, we wanted to formally embed our gender lens to investment decisions, leading us to work with Value for Women in 2021. This partnership resulted in our gender equality statement and refined our strategy, integrating gender equity in team assessments and due diligence, as well as the incorporation in the investment strategy of uMunthu II, our current EUR 150 million fund focused on inclusive growth in Africa. This commitment reflects our dedication to addressing these challenges head-on.

Promising examples are leading the way

When reflecting on what Goodwell has learned so far on gender equality, Els emphasises the importance of embracing change. “The journey towards true inclusion requires continuous effort and dedication. It’s not only about diversifying the faces in the room but also ensuring that diverse voices are heard and valued in decision-making processes. It’s about fostering a culture where every individual feels respected, valued, and empowered to contribute their unique insights.”

This effort has led to investments that exemplify the transformative power of focusing on female entrepreneurs, and the positive ripple effect they can create across their communities and regions.

- In Kenya, Grace Kariuki of Origen Fresh is empowering women within the company and providing female farmers new income streams.

- In northern Nigeria, Mira Mehta of Tomato Jos is producing nutritious food products and creating new job opportunities and a safe working environment for women in a highly challenging region.

- In South Africa, Indira Gopalkrishna of Inclusivity Solutions is making insurance easily available, helping people protect themselves from the unforeseen shocks that are often at the heart of poverty and inequality.

- And co-founded by Kellan Hays, Zambia-based Good Nature Agro is helping (female) farmers diversify their incomes, access financing, and build more stable futures.

Companies don’t need to be led by women to positively benefit them. Other examples like Instill, OmniRetail, and SOUK Farms demonstrate that businesses serving women as employees, consumers, and community members can have profound ripple effects. Based in South Africa and operating in three countries, lnstill Education delivers teacher training to improve the quality of teachers and thereby education outcomes across the continent. Their flexible learning modules are specifically designed for female teachers juggling a wide variety of personal and professional responsibilities. In Nigeria, OmniRetail makes it easier for informal retailers – many of them women – to resupply their shops and access small loans. SOUK Farms in Rwanda is bringing reliable employment and better incomes to their 1,500 employees – 70% of whom are women.

Mira Mehta and the Tomato Jos team

Equality is still a long way off

Female-led ventures currently receive less than 5% of total VC capital raised. As long as we live in a world where the majority of funding goes to men, investment firms must remain vigilant and embed gender inclusion into every layer of their investment strategy to keep incrementally increasing that number. Goodwell has a clear objective to mainstream gender lens investment, with increased investments in businesses catering to women’s needs, fostering both financial and social impact. If the impact investing industry follows a similar trajectory, Disrupt Africa’s next Diversity Dividend report might have a more positive story to tell.

Download the full 2024 Diversity Dividend report to learn more about the state of investing in female entrepreneurs in Africa. And if you’re running a growing business based in Africa that’s creating a positive impact for women, please get in touch: contact@goodwell.nl.