Investing at the intersection of climate and social impact

With every passing year, it’s becoming more obvious that social impact and climate impact go hand in hand. Our mission is to do well by doing good. We believe in a world where no one is left behind, aiming to serve the un(der)served by expanding access to high-quality, everyday goods and services. Since Goodwell was founded two decades ago, we’ve witnessed an increasing consideration of investments through a climate lens. Efforts to build a more inclusive world, socially and economically, are inherently tied to building climate resilience in underserved communities. Climate lens investing can reduce the disproportionate impact of climate change on such vulnerable populations, complementing efforts to build a more inclusive society.

Social impact is inherently tied to climate resilience

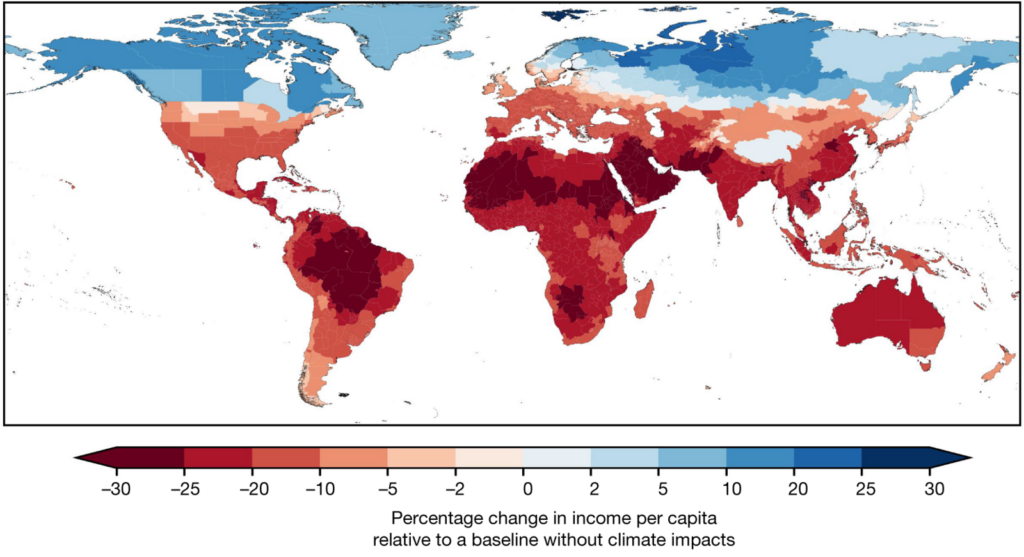

Goodwell has always emphasised making positive social impact, from our beginnings in the financial inclusion space, to our current interests across many different sectors and regions. We’ve created substantial social change, positively affecting over 39 million households across thousands of communities in Africa and India. These same communities, however, are often the very ones hit hardest by climate change – even though they typically contribute least to greenhouse gas emissions. Not only that; the World Bank estimates that climate change could push a further 68 – 135 million people into poverty by 2030, making our vision of an inclusive future look like a Sisyphean task.

Source: https://commons.wikimedia.org/wiki/File:Kotz_2024_aggregate_impacts_map.png

Climate change impacts us all, but that harsh truth also creates the opportunity to bring many different stakeholders to the table to build solutions based on coalition and partnership. This is why climate lens investing is so crucial: it enables sustainable, equitable development while catalysing holistic, systemic change. Goodwell looks at every investment we make through a climate lens, seeking inclusive, technology-led opportunities to mitigate or adapt to the effects of climate change. We focus on sectors that can provide tangible solutions to improve the resilience of the communities we work in – and beyond.

A holistic, principled approach to climate solutions

Our investments must play a role in building climate resilience, from creating more efficient supply chains or introducing electric vehicles, to developing drought-resistant agricultural crops. We’ve defined climate investment principles to guide our decision-making – and have worked these into our investment mandates on multiple levels. For starters, we have a rigid exclusion list of sectors we will never invest in. For other sectors, we look for companies committed to key climate principles:

- Adaptation: Strengthening resilience of vulnerable communities

- Mitigation: Reducing greenhouse gas emissions across sectors

- Innovation: Leveraging technology for climate-smart solutions

- Inclusivity: Ensuring equitable access to climate resilience

Each sector we do invest in contributes to our overall, holistic climate strategy. Within the agricultural sector, for example, one of our main focuses is to reduce food waste. We invest in clean energy and more sustainable waste management. In the financial inclusion space, we work to enable people to deal with, and recover from, unexpected shocks (including climate-related ones). For mobility and logistics, we explicitly support increased transport efficiency and the uptake of electric vehicles.

Climate resilience in action

We’re proud to say that the companies in our portfolio make a variety of contributions to climate resilience, while also contributing to several other impact areas, such as job creation or reduced inequality. Let’s look at some specific examples from our portfolio:

Food and agriculture

The Kenyan female-led company Origen Fresh not only helps to reduce food waste and post-harvest losses of avocados, but they’re also taking a circular approach to powering their factory, using post-processing waste as fuel. EA Foods from Tanzania reduces post-harvest losses for smallholder farmers across sub-Saharan Africa by using efficient cold chain logistics for fast delivery to local markets. Tomato Jos works to increase yields and incomes of local Nigerian smallholder farmers, combatting unnecessary greenhouse gas emissions from food imports with local, high-quality tomatoes, soya, and maize. Another of our portfolio companies, Good Nature Agro, partners with smallholder farmers in Zambia and Malawi in the development and distribution of drought- and pest-resistant crops, promoting soil-revitalising legume farming and training farmers in climate-smart agriculture.

Mobility and logistics

We are also a proud investor in Haul247 from Nigeria. Haul247 optimises storage and haulage capacity and transport efficiency to cut down on emissions and reduce post-harvest food losses. MAX is increasing the number of electric motorbikes on Nigerian roads, supporting the financing of a fleet of electric vehicles, with access to state-of-the-art battery swapping stations. Since we invested in 2019, the company has grown from a logistics and financial inclusion company to an EV and energy transition company. MAX is an excellent example of how climate lens investing and inclusive business investments are intertwined.

Looking inward and forward

Climate lens investing touches all sectors, all areas, and all actors in the ecosystem, including our own policies and actions. Goodwell was recently certified as a B Corp, meaning we have been independently, transparently confirmed as committed to creating positive impact. Part of the B Corp journey is embracing a path of continuous improvement, and for us, that includes our in-house environmental, sustainability and governance responsibilities. We’re actively working to further reduce our own environmental footprint and learning best practices from our industry peers and partners, like Alitheia Capital, to implement more climate-specific metrics into our monitoring and reporting.

Goodwell’s climate lens also encourages us to look for investment opportunities in new industries with direct climate impact potential, such as waste management. After all, environmental impact and social impact are two sides of the same coin: to address one is to address the other. Climate change is an intersectional issue. As an impact investor, Goodwell has seen firsthand how business solutions in emerging markets converge and has valuable experience in fostering intersectional solutions. Acknowledging and embracing that intersection is the best way to sustainably tackle our world’s biggest challenges.