Goodwell Investments backs Inclusivity Solutions with follow-on investment

PRESS RELEASE

Inclusive Insurtech startup Inclusivity Solutions Secures US$1.3 million in the Second Tranche of its Series A Round, from Goodwell Investments, UW Ventures, and MFS Africa

This timely investment underscores the commitment by investors to the growth of inclusive digital insurance solutions dedicated to addressing risks, such as COVID-19, faced by the majority underserved consumers in emerging markets.

CAPE TOWN, 27 May 2020. Inclusivity Solutions, the company that designs, builds, operates and innovates digital insurance solutions, has secured an additional US$ 1.3 million in its second tranche of its Series A round, bringing the total Series A round to US$2.6m. Following on from their first tranche investment, the uMunthu fund, managed by Goodwell Investments, led the round with follow-on investment from UW Ventures (in partnership with Allan Gray). MFS Africa, a leading Pan-African fintech company, joined the round as a new investor.

Inclusivity Solutions has already successfully launched digital insurance initiatives in Cote d’Ivoire, Rwanda and Kenya, in partnership with Orange, Airtel and Equity Bank’s Equitel respectively. Collectively a range of hospital cash and simple life products have provided protection to more than 700,000 people. The investment will be used to deepen the company’s footprint within its existing markets, support further international expansion as well as accelerate innovation in the backbone technology platform, ASPin, which underpins the three existing products.

Founder and CEO, Jeremy Leach commented: “As the humanitarian and economic disaster that is COVID-19 unfolds, we are reassured that there could not be a more important time for insurance solutions such as ours to play a role in protecting the vulnerable. This investment provides the endorsement and support that we need as an organization to continue our work in designing and scaling products that address the risks that really matter and can play a real role in adding value to consumers, as well as offering a digital-ready solution to insurers during operationally challenging times.”

Wim van der Beek, managing partner Goodwell Investments: “We are excited to lead this second tranche and make this additional investment from our uMunthu fund, especially in these challenging times. Our investment focus is inclusive growth, and we believe that collaborative insurtech solutions like Inclusivity Solutions are best positioned to reach large numbers of underserved consumers. Their model bridges the insurance protection gap for underserved through products that are designed to be simple, affordable and accessible, even on the most basic mobile phone. It is a perfect fit with our mandate, and we look forward to continue to support Inclusivity Solutions in its next stage of growth.”

“We could not think of a more relevant time for this additional support to Inclusivity Solutions to further their mission of designing innovative and inclusive financial products while developing insurance markets to protect and serve vulnerable communities across the developing world. We believe there is a huge opportunity to bring affordable health and life insurance to those communities that may be the most ill-equipped to deal with catastrophes such as COVID-19, and we are excited to partner with Jeremy Leach and his exceptional team to help achieve their ambitions.” Harry Apostoleris, Director, UW Ventures.

Dare Okoudjou, founder and CEO of MFS Africa commented, “I’ve known the Inclusivity team for many years, and as players in the fintech space ourselves, we have had the opportunity to collaborate with them on a few exciting opportunities. We share a passion for impact through technology, and a drive to innovate and implement. We at MFS Africa are very proud to be part of their next stage of growth.” Okoudjou added, “The investment was made through MFS Africa Frontiers, a vehicle dedicated to exploring Frontier opportunities in the greater fintech ecosystem. Through MFS Africa Frontiers, we invest in select ventures with whom we feel we can go further – and faster – together.”

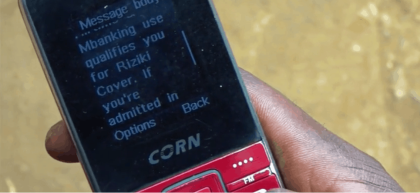

Consumers such as primary school teacher, Peter, are now benefiting from these products. Through Riziki Cover, a product designed and operated by Inclusivity Solutions and delivered through Equitel in Kenya, Peter was able to cover his bills after being hospitalized for five nights.

Jeremy Leach: “Our obsession is to build products that directly meet the needs of consumers, consumers like Peter, and to make them simple to understand and easy to use. With insurance penetration at only 5.5 per cent of the adult population in Kenya, Peter would likely be without insurance today were it not for our innovative products. We are grateful and excited to have the support of these leading investors and partners who share our vision for a world with better protection.”

ENDS

Inclusivity Solutions designs, builds and operates inclusive digital insurance solutions. Inclusivity Solutions partners with banks, mobile operators, insurance companies and other distribution partners to deliver insurance solutions through digital channels, that meet the needs of emerging consumers and achieve long-term social and financial impact.